Updated for September, 2025

What is Lenox Home Loans & WesLand Financial?

Lenox Financial Mortgage Corporation (Lenox Home Loans) also conducts business as WesLend Financial or WesLend Financial Corp. in certain states. Don’t let the four different names confuse you, they all provide the same services. The company is a nationwide mortgage provider that provides loans such as GHA, VA, Conventional, HARP, and reverse mortgages. If you’ve visited their website, you may have seen that their tagline is “home of the biggest no brainer.” So, do they actually offer the best deals? And should you choose them while shopping for mortgage lenders?

Is Lenox Home Loans / WesLand Financial Legit?

Yes. Lenox Home Loans (WesLand Financial) is a legitimate company based in southern California. The company has been around for over 20 years. They are a direct seller/servicer with Fannie Mae and Freddie Mac, and also offer all types of government home loans, including FHA, USDA, and VA loans. They are also accredited with the Better Business Bureau, which is an important thing to look for before choosing to work with any loan company. As of 2021, they receive an A+ rating by the BBB, but have a rating of 2.27 out of 5 stars by customers. In other words, they’re legitimate. But for whatever reason, also may have some unsatisfied customers.

What loan options do they offer?

Lenox Home Loans offers:

- Conventional home loans (Conforming and Jumbo)

- FHA loans

- USDA loans

- VA loans

- Mortgage refinance loans

- Reverse mortgage

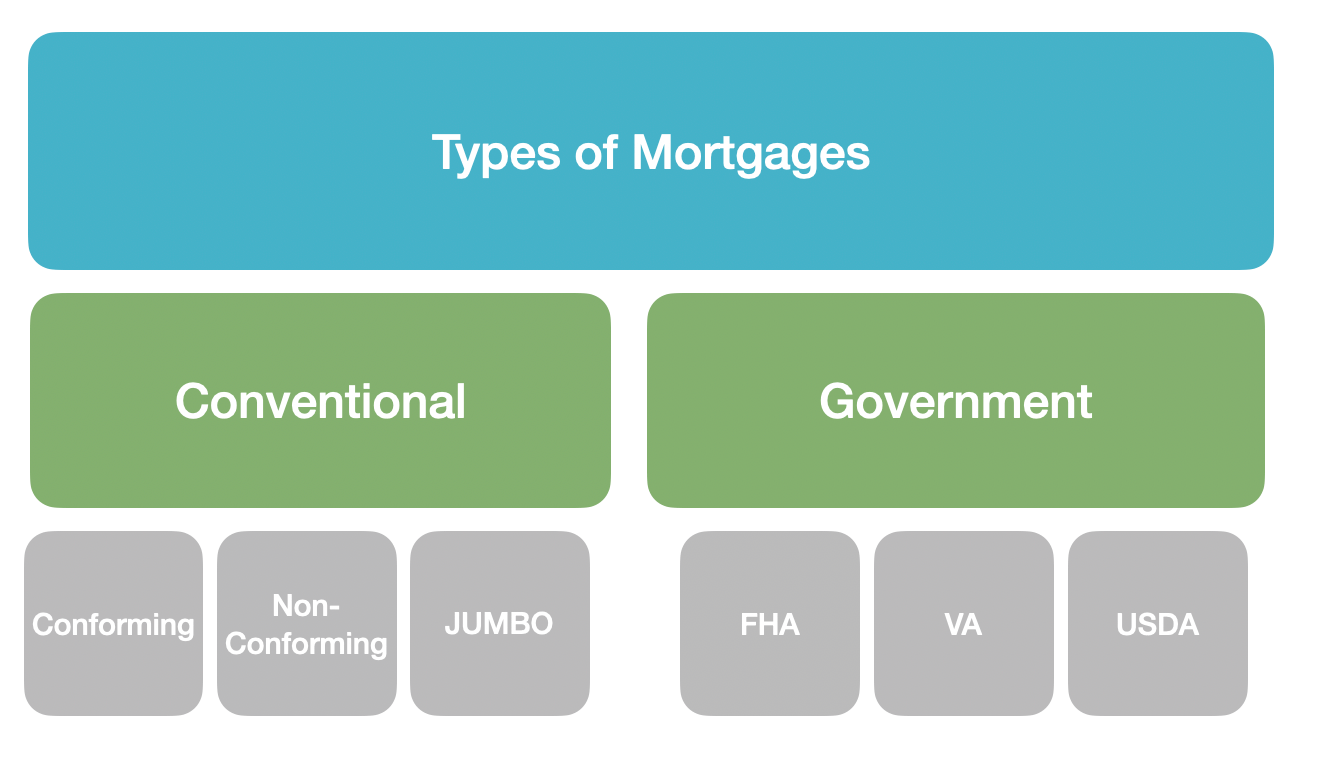

The general types of mortgages fall into these categories:

Conventional vs. Government Loans

Lenox Home Loans offers both types. Here’s a quick breakdown of the difference:

Conventional loans are are not insured by the government. They are typically more difficult to qualify for, and borrowers need to prove good credit, a steady income, and have money on-hand for a down payment.

On the other hand, government loans are insured by the government. The most popular government loans are VA and FHA. They will typically have lower closing costs than conventional loans. Those with lower credit scores may still be able to qualify for government loans. These types of loans are not granted by the government itself, but rather secured through an FHA/VA approved lender, like Lenox Financial.

What is the Lenox Home Loans application process like?

We found the application process to be relatively easy. You can apply directly on their website and request a quick quote from a loan officer. The website also has a chat option if you need to get in touch with someone.

You can request a quick quote by putting in information such as your name, state, email, the type of loan you’re shopping for, and your phone number. Based on our research, a loan officer will call you within a few days of submitting this information.

They claim to close loans quickly (just over 30 days), however some reviews from customers on popular review websites have claimed to experience a much longer process. It is likely unique for every application and unique financial situation.

The Pros & Cons of Lenox Home Loans

Pros

- Many loan options available

- Can apply online

- Generally positive reviews

- No closing cost options available (but not in Washington)

Cons

- Not transparent with fees

- Not available in all states

- Longer processing times from some reviews

Overall

Though most users claim to have positive experiences with Lenox / WesLand, there are two downsides we found off the bat. The most noticeable one being that the website is not initially transparent with rates and fees. Understandably, mortgage rates will be unique to each person’s financial situation. But the website does not disclose the kinds of loan processing or origination fees they charge. It seems like you’ll need to put in some information and request a quote to get a sense of how much you’ll owe. The second downside is that Lenox Financial services are not available in all 50 states.

What States does Lenox Home Loans not serve?

Based on our research in 2021, Lenox Financial Services does not do business in Alaska, Delaware, Montana, Nebraska, Nevada, North Dakota, Wisconsin, Wyoming, or the District of Columbia.

Final Thoughts

So is Lenox Home Loans actually a no brainer as their slogan advertises? The bottom line is: Lenox / WesLand does have a variety of home loan programs available, with numerous positive reviews from customers online. They operate in most states and have an easy application process online. However, some customer reviews have claimed the company takes a long time to close, and they do not disclose lender fees online. This means you’ll have to do your own research and compare the best options amongst other home loan companies based on your financial situation to determine what the best option is for you.